skip to main |

skip to sidebar

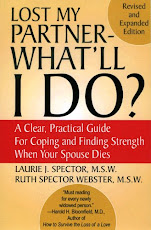

for widows, widowers and the people who care about them

WELCOME

Whether you've lost your spouse/partner or care about someone who has, this is a place to find support and share your experiences with others in the same situation.

New to blogs and want to add your response? Click onto "Comments" at the bottom of any post.

New to blogs and want to add your response? Click onto "Comments" at the bottom of any post.

CATEGORIES

- adult child (12)

- blog (15)

- children's reactions (13)

- finding support (14)

- getting out and about (2)

- holiday hurdles (22)

- job adjustments (2)

- legal/financial (8)

- loss of husband (15)

- loss of spouse/partner (59)

- military (6)

- new relationships (6)

- on your own (5)

- pets and loss (3)

- reflections (30)

- social situations (33)

- sudden death (4)

- suicide (6)

- symptoms of grief (46)

- traveling without your partner (5)

- ways to cope (57)

- widow (25)

- widower (20)

- widowhood way back when (17)

- young widowed (9)

BLOG ARCHIVES

-

▼

2024

(58)

-

▼

July

(8)

- when adults lose a parent; part 2: ways to cope

- when adults lose a parent; part 1: your reactions

- i'm not the typical partner: part 2

- i'm not the typical partner: part 1

- protect your late partner's identity; part 2

- protect your late partner from identity theft; part 1

- widowhood way back when: revolutionary war pensions

- you and your adult child: emotional guidance

-

▼

July

(8)

SUBSCRIBE NOW

DISCLAIMER

The contents of this site are for informational and/or educational purposes only. The material provided on this site is not to be used as a substitute for professional psychological, psychiatric or medical advice, diagnosis or treatment.

If you have any questions or concerns regarding a psychological or medical issue or problem, always seek the advice of a physician and/or psychiatrist or a qualified mental health professional.

If you are having thoughts about suicide or doing harm to others, seek immediate professional help by calling your local suicide hotline (your telephone operator can connect you), or by contacting the National Suicide Hotline either by phone (1-800-273-8255), or online at: suicidepreventionhelpline.org.

No theraputic relationship is constituted by the use of this site. Any advice or information is provided on an "as-is" basis. Any reliance on any advice or information provided by Ruth Webster, M.S.W. and/or Laurie J. Spector, M.S.W. or any other person or professional on this site is solely at your own risk. Ruth Webster, Laurie J. Spector, lostmypartnerblog.com, and McCormick Press make no representations as to accuracy, completeness, suitability, or validity of any information on this site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use.

The owners of this site are not responsible for the content of any linked sites.

Copyright 2024, by Ruth Webster, M.S.W. and Laurie J. Spector, M.S.W. All rights and all media reserved.